its beyond vision

Our financial services are built for creators, entrepreneurs, freelancers, and small businesses—so you can focus on what you do best and leave the math to us.

Why Clients Love Working With Us

We simplify your numbers, optimize your tax planning, and help you make decisions backed by real data—not guesswork. From day-to-day bookkeeping to forward-thinking financial forecasting, we’re your strategic finance partner every step of the way.

Bookkeeping & Reporting – Audit-Ready

We keep your records clean, current, and compliant. From monthly reports to annual statements, our bookkeeping ensures you're always prepared for growth, funding rounds.

Tax Strategy & Compliance – Avoid Penalties

Tax season doesn’t have to be stressful. We develop personalized tax strategies to reduce liabilities, stay compliant, and take advantage of every opportunity legally available to you.

Financial Forecasting – Plan with Confidence

Know your numbers before they become problems. We project your income, cash flow, and expenses so you can make smarter moves, prepare for growth, and avoid financial blind spots.

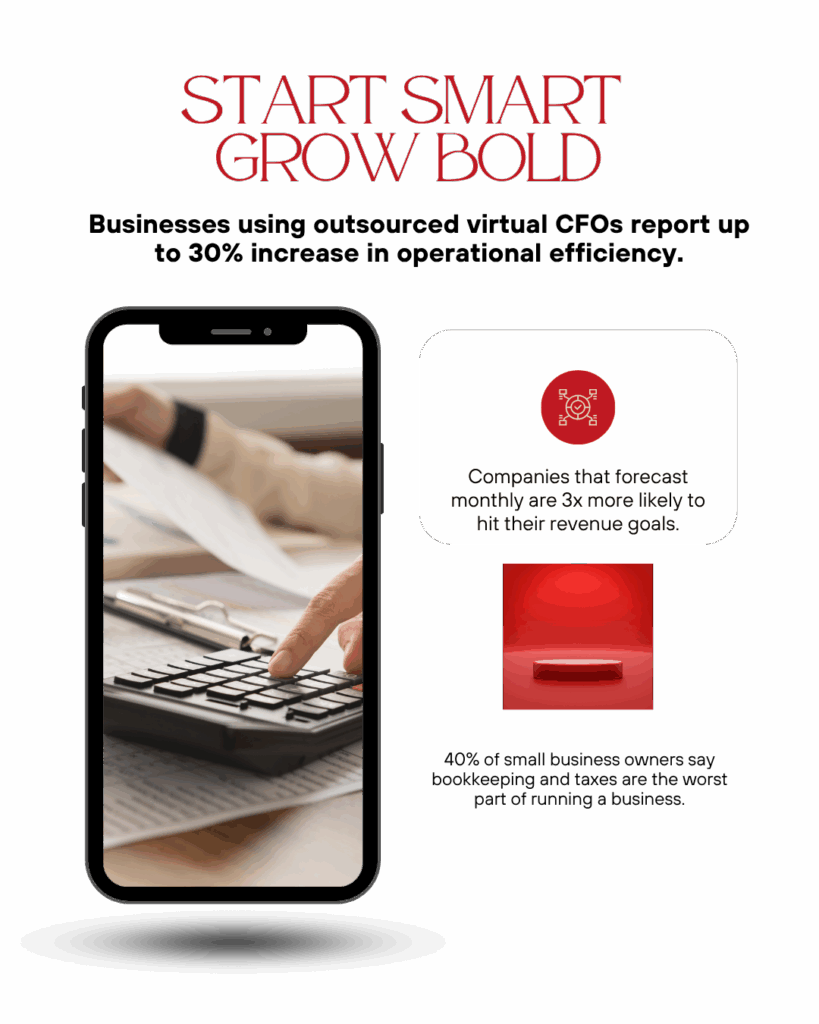

Virtual CFO Services – Executive-Level Insights

Need strategic financial guidance without the full-time cost? Our Virtual CFOs help with budgeting, financial planning, investor readiness, and executive-level decision-making—tailored to your business goals.

Payroll Management – Pay Your People, Stress-Free

We handle accurate, timely payroll processing—whether for a team of two or twenty. From salaries to statutory filings, we ensure compliance with local laws and take the admin burden off your plate.

Invoicing & Accounts Receivable – Get Paid On Time

We streamline your invoicing and follow-up processes so cash flows in smoothly. With our support, you’ll reduce late payments, improve client communication, and maintain healthy business relationships.

numbers

Businesses with professional accounting support grow 2x faster than those without.

Frequently Asked Questions